TAX BENEFIT & GAIN DEFERRAL INVESTMENTS

POTENTIAL CURRENT YEAR TAX DEDUCTION, TAX MITIGATION AND CAPITAL GAIN DEFERRAL THROUGH PRIVATE INVESTMENTS

Through Exclusive Advisors, we have access to a number of private investment programs that offer various potential tax benefits. These types of investments are typically Regulation D Private Placement offerings structured as an LP or LLC, and are available for accredited investors only. Tax considerations associated with these types of investment programs are complex and vary with individual circumstances. At Exclusive Advisors, we can help coordinate and review the options available with you, your CPA, and/or qualified intermediary to determine which program best fits your individual situation.

POTENTIAL TAX BENEFITS THROUGH 1031 DST REPLACEMENT PROPERTIES

Section 1031 of the Internal Revenue Code provides an effective strategy for deferring the capital gains that may arise from an investment property sale. By exchanging an investment property for like-kind real estate, property owners may defer the tax and depreciation recapture on a capital gain. The IRS defines "like-kind" broadly by nature and character, not by type, allowing investors the ability to exchange into almost any type of investment or business real estate such as multifamily, healthcare, industrial, student housing, retail, anchor tenant grocery, self-storage, hospitality, undeveloped land and oil/gas mineral rights. For example, an investor can initiate a 1031 exchange from the sale of a rental house into a commercial building -or- an undeveloped land investment -or- an oil/gas mineral rights investment and it will be considered a "like-kind" exchange under the rules.

Exclusive Advisors provides access to a wide variety of 1031 DST replacement sponsor-affiliated programs for a property owner to choose from. Unlike traditional Tenant-in-Common or TIC replacement property, we exclusively recommend replacement properties structured as DSTs or Delaware Statutory Trusts. The DST structure creates a passive replacement opportunity that takes all decision making out of the hands of the investor and places it into the hands of a sponsor affiliated trustee.

There are many advantages of a DST structured 1031 replacement program. Costs to the investors participating in the DST are much lower than the costs of a TIC program. In a DST program, investors do not need to incur the annual costs of maintenance and qualification of a special purpose LLC to hold their real estate interest. In addition, DST investors are not required to execute a guarantee or indemnities. Furthermore, because all management authority in a DST is vested in the sponsor affiliated trustee, there is no risk of investors being held hostage by a "rogue investor", as has occurred too often in TIC situations.

Other advantages of a DST 1031 program structure include:

-

Create an attractive monthly income stream without the burden of active real estate ownership.

-

Ability to choose properties in many sectors including retail, office, industrial, medical, self-storage, multifamily and royalties & mineral rights.

-

Original property cost basis remains in-tact with replacement property maintaining the potential for a step up in basis upon the owners death.

-

Low minimum investment amounts (typically $25,000 to $100,000) give you the ability to identify and exchange into a multiple asset portfolio of replacement properties.

-

Ability to choose from highly leveraged, moderately leveraged, or no leverage offerings.

-

Benefit from professional real estate expertise, including acquisition, financing, property management and asset management.

-

Tax reporting for DSTs via substitute 1098/1099 not K-1.

To avoid incurring a taxable event, exchange investors may not have actual or constructive receipt of the proceeds from their relinquished property sale. For this reason, any potential exchange investor should pre-arrange the services of a Qualified Intermediary or "QI" to coordinate the exchange before the property sale closes.

CLICK BELOW FOR MORE INFORMATION

POTENTIAL TAX BENEFITS THROUGH OPPORTUNITY ZONE FUNDS

Opportunity Zone Funds provide investors a unique opportunity to defer capital gains by reinvesting into tax advantaged opportunistic/value-add real estate targeting new construction and underutilized assets within transit-oriented and/or urban-centric Opportunity Zones.

The Opportunity Zones rules were established by Congress in the Tax Cuts and Jobs Act of 2017 (aka OZ 1.0) and later made permanent on July 4th, 2025 under the One Big Beautiful Bill Act (aka OZ 2.0). Opportunity Zones were originally created as an innovative approach to spur long-term private sector investments in low-income urban and rural communities nationwide. The program allows each state governor to establish Opportunity Zones where new Opportunity Funds would make targeted investments.

Starting January 1, 2027, an investor may reinvest a portion or all of a short-term or long-term realized gain from sale of any asset (stocks, bonds, real estate, business, art, crypto, etc.) into an OZ 2.0 fund. This allows an investor to defer and reduce their capital gain tax liability and potentially face no capital gains or depreciation recapture on Opportunity Zone investments if held for at least 10 years. The typical minimum investment of these programs is $100,000.

Other tax benefit strategies that defer gains, typically require the reinvestment of all sales proceeds (e.g., like-kind exchanges, involuntary conversions, etc.). For example, unlike a 1031 like-kind exchange, a taxpayer need only reinvest their gains, not the entire proceeds from the sale of an asset into an OZ 2.0 fund. Under the OZ 2.0 rules, the investors original principal (cost basis) is separate and can be re-deployed as the investor sees fit. With Opportunity Zone investments, any gain can be deferred including long-term, short-term, ordinary and Section 1231.

The key to understanding this strategy is to focus on the word “deferral” and then visualize the original deferred gain and the eventual complete elimination of the gain as well as the growth on that gain in separate buckets.

According to the latest IRS guidance on OZ 2.0, the program works like this: Since the OZ 2.0 rules don't start until January 1, 2027, only capital gains realized July 1, 2026, or later, will have the ability to be deferred under the new OZ 2.0 rules using the 180-day window.

Let's assume you recognize a $1,000,000 profit (gain) on the sale of a business, investment property, or stock sale on July 1, 2026, or later. If you invest the $1,000,000 into an OZ 2.0 program within a 180-day window on January 1, 2027, or later, you will begin a 5-year capital gain deferral from the date of your investment. Beginning that year and each year thereafter, your capital gain deferral will be reported to the IRS using Form 8997 which is filed with your tax return. You will have to report and pay taxes on the deferred gains in the 6th year following your investment with the following incentives: After five years, you will get a 10% basis increase on the deferred gain or a 30% basis increase for investments into rural opportunity zone funds. And yes, Exclusive Advisors has access to rural opportunity zone programs.

Using the $1,000,000 example above, in the 6th year, you will have to report and pay taxes on either a $900,000 capital gain (10% basis increase) -or- report and pay taxes on a $700,000 capital gain (30% increase) for a rural OZ 2.0 fund investment. The new OZ 2.0 programs will be designed to initiate a refinance distribution between the 5th and 6th year to help you pay the capital gains tax due in the 6th year.

After holding the OZ 2.0 investment for 10 years, much like a Roth IRA, you will have the ability to make a permanent tax-free exit for any gains on your original investment. For example, if your original $1,000,000 OZ 2.0 investment grows to $3,000,000, the $3,000,000 is completely non-taxable and there will be no depreciation recapture when the OZ 2.0 fund is sold and liquidated.

OPPORTUNITY ZONE 2.0 DATES

POTENTIAL TAX BENEFITS THROUGH ENERGY TAX CREDIT PROGRAMS

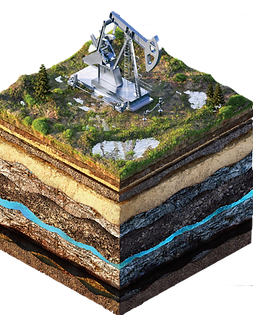

In order to spur private investment in developing American energy and reduce our dependence on imports, unique and powerful tax advantages are afforded to direct investments in drilling American oil and natural gas wells.

Capital raised from investors is used to drill new developmental horizontal oil and/or natural gas wells on properties in close vicinity of existing, proven wells. Should you invest as an investor general partner, the investment can provide an attractive tax write-off ranging from 75% to 85% of every dollar invested that can be used to offset any type of taxable income or gain, including lowering your AMT by up to 40%. Once the program wells begin production and the energy commodity is sold, investors can enjoy an attractive long-term tax-advantaged monthly income for the life of the program.

Disclaimer: Keep in mind this tax considerations are applicable as the current tax laws have been written. These exemptions have been around for some time, but are subject to congressional change and IRS guidance.